Rafael Alvarez, age 61, of Cortlandt Manor, entered the plea in Manhattan federal court on Tuesday, Dec. 17, after being charged with conspiracy to defraud the US and aiding the preparation of false tax returns, according to Edward Y. Kim, Acting US Attorney for the Southern District of New York.

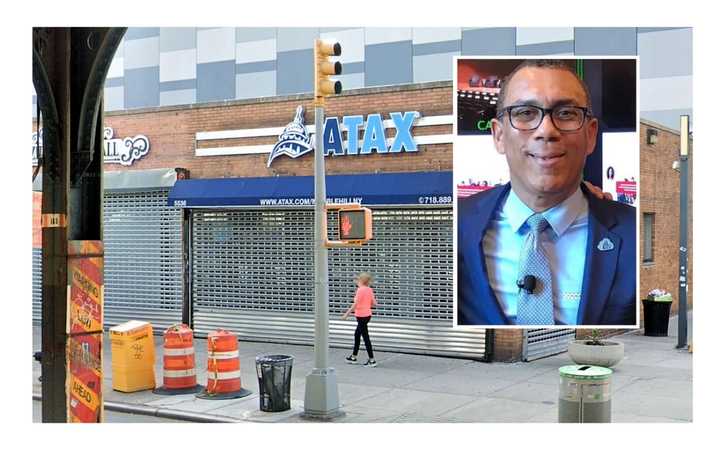

Alvarez, the CEO and owner of ATAX, a Bronx-based tax preparation business, was accused of submitting tens of thousands of fraudulent federal tax returns from 2010 through 2020. Prosecutors said Alvarez and his team used fake deductions, fabricated losses, and bogus credits to illegally reduce taxes for customers, costing the IRS $145 million in lost revenue.

ATAX, which Alvarez operated during the scheme, prepared approximately 90,000 federal income tax returns over the 10-year period. Prosecutors said Alvarez personally oversaw and directed employees to falsify returns to secure larger refunds for clients.

Alvarez’s tactics earned him the nickname “The Magician” among his clients for seemingly making their tax burdens vanish. However, federal prosecutors called his actions a serious crime that deprived the government of massive sums of tax revenue.

“Today’s guilty plea, in one of the largest ever tax frauds by a return preparer, should serve as an important reminder to tax professionals that this Office will vigorously investigate and prosecute tax offenses,” Kim said.

In addition to his plea, Alvarez agreed to pay $145 million in restitution to the IRS and forfeit over $11.8 million in proceeds from the scheme.

Alvarez now faces up to five years in prison for conspiracy and an additional three years for aiding in the preparation of false tax returns. His sentencing is scheduled for Friday, April 11, 2025, before U.S. District Judge J. Paul Oetken.

Click here to follow Daily Voice Armonk and receive free news updates.